Daily Business Report-July 23, 2015

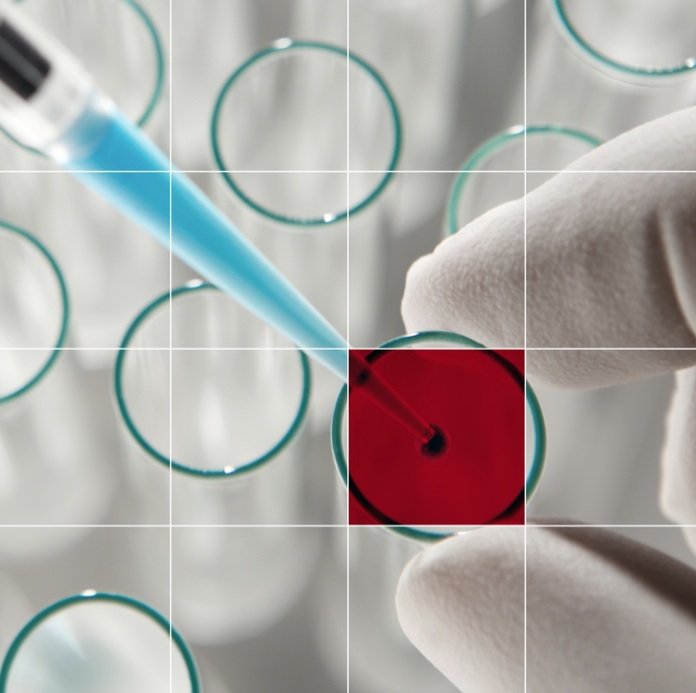

A researcher in an Eli Lilly lab. (Courtesy Eli Lilly and Co.)

Eli Lilly to Double Research

Operations in San Diego

Times of San Diego

Life sciences giant Eli Lilly and Co. announced plans Thursday to expand its Lilly Biotechnology Center near UC San Diego, effectively doubling its local research presence.

Set to be completed in 2016, the expansion will create up to 130 new jobs, many for experts in biotechnology, chemistry and immunology. The company is adding 175,000 square feet of research space by taking over a nearby building being vacated by Qualcomm.

“San Diego has been an important location for Lilly laboratories for more than a decade. The city is a global hub for biomedical research and talent, where collaboration between academic institutions and biotechnology thrives,” said Thomas F. Bumol, Ph.D., senior vice president, biotechnology and immunology research at Lilly.

“We want to build on our success in San Diego through expanded collaborations that ultimately allow us to bring better medicines to people faster than ever before.”

The company said the new space will allow for closer collaboration among Lilly experts in discovery chemistry, research technologies and biotechnology, fostering collaboration which will help accelerate the discovery of new medicines.

Indianapolis-based Lilly initially entered the San Diego area in 2004 by acquiring Applied Molecular Evolution, which now operates as a subsidiary of the company. The Lilly Biotechnology Center was officially established in 2009 and is located on Campus Point Drive north of Scripps Memorial Hospital.

San Diego Daily Transcript

To Cease Operations

‘The company is no longer a viable business’

City News Service

The San Diego Daily Transcript, which has covered local business, law and real estate for 130 years, announced Wednesday that it will cease operations next month. The final edition will be published Sept. 1, and the newspaper will close Sept. 21, publisher Robert Loomis said.

“The changing publishing paradigm has made the maintenance of a news organization of the size and scope represented by The Daily Transcript/San Diego Source in a market of San Diego’s size problematic,” Loomis wrote in a message to readers. “While many cost-savings measures have been initiated in the past, including the enthusiastic embrace of rapidly changing technology, producing the daily news, data and information for which the company is known requires a relatively large number of employees with related support systems. Increasing overhead, health care costs and the uncertain future of the news industry dictate that the company is no longer a viable business.”

He said that after the last edition is printed, the paid subscription website at www.sddt.com will remain active for a few more weeks.

“We hope a local university or library will accept the donation of our past editions and possibly even the web database so the news, data and information from the past can be a resource for future San Diego researchers and business people,” Loomis said.

According to its website, the Transcript’s roots go back to 1882, when it began publishing as the National City Record. It changed names through a variety of owners, and took on the Transcript name in 1886.

The current owners acquired the company in 1986.

Longtime publisher Ellen Revelle, who died in 2009, was the granddaughter of James E. Scripps, founder of The Detroit News, and the grandniece of E.W. Scripps, who established the Scripps Howard newspaper chain.

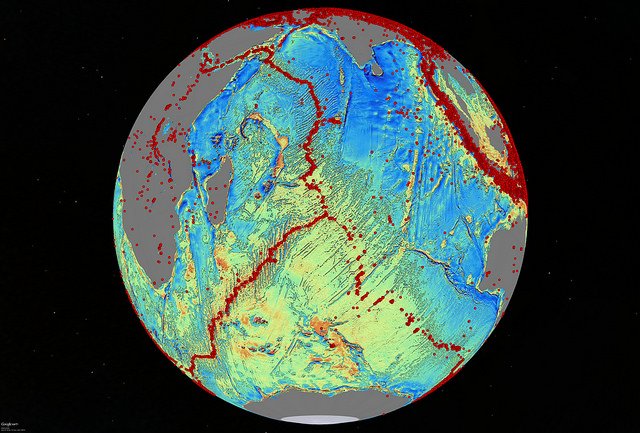

Her husband, Roger Revelle, a prominent scientist and oceanographer at Scripps Institution of Oceanography, was instrumental in bringing the University of California to San Diego. Their son, William Revelle, is the company chairman.

The Transcript launched San Diego Source in 1994, becoming the first newspaper in Southern California to publish on the Internet.

San Diego County’s Life Science Sector

Ranked 4th Nationally, Down from 2014

Although San Diego County’s life science sector was ranked fourth in the nation in 2015 — down from third place last year — the region excels in genomics and as an R&D headquarters for many major pharmaceutical companies, primarily because of the depth of the area’s talent pool, according to a new report from JLL.

The report by the commercial real estate company also said:

• San Diego currently has about 1 million square feet of life science tenant demand in its real estate market.

• Strong life science user demand is giving rise to some new construction and a lot of conversion activity, despite the expense of converting a building to lab/life science use.

But the JLL report also said rising rents will continue to affect the bottom line for pharmaceutical firms. The average rent for lab space in major markets across the United States is $24.30 per square foot, up from $23.60 in 2014, the report said. In San Diego, the rent for lab space was $29.90 this year, up 15.5 percent from $25.80 last year.

The top 10 life science clusters as ranked by JLL:

1. Greater Boston Area

2. Raleigh-Durham

3. San Francisco Bay Area

4. San Diego

5. New York City

6. Los Angeles/Orange County

7. Philadelphia

8. Long Island

9. Minneapolis

10. Seattle

UC Raising Its Minimum Wage to $15 An Hour

City News Service

Workers at UC San Diego and other University of California campuses across the state will be getting raises, with the university president announcing plans Wednesday to increase the minimum wage for employees to $15 an hour over the next three years.

“This is the right thing to do — for our workers and their families, for our mission and values, to enhance UC’s leadership role by becoming the first public university in the United States to voluntarily establish a minimum wage of $15,” UC President Janet Napolitano said.

Under the plan unveiled at the UC Board of Regents meeting, wages for direct and contract employees will increase to $13 an hour on Oct. 1, then to $14 an hour on Oct. 1, 2016 and $15 on Oct. 1, 2017.

The state’s current minimum wage is $9, and will increase to $10 an hour on Jan. 1.

The University of California system is the state’s third-largest employer, with about 195,000 employees at its 10 campuses, five medical centers, three national labs, the Office of the President, Division of Agriculture and Natural Resources and other locations, according to UC.

As part of the wage-hike plan, the UC also plans to expand its monitoring to ensure employees of contract companies are being paid the proper wages.

Quidel’s Second Quarter Revenues

Rise 11 Percent on New Product Sales

GenomeWeb

San Diego-based Quidel reported after the close of the market on Tuesday that its first quarter revenues grew 11 percent year over year led by new product sales, particularly of its Sofia immunoassays. Revenues for the three months ended June 30 increased to $34.9 million from $31.5 million in Q2 2014, above the average analysts’ estimate of $34.2 million.

The firm said that new product revenues increased 120 percent year over year to $6.9 million, due primarily to sales of its Sofia assays, followed by increased molecular and Graves’ disease product sales. Specifically, Sofia product revenues increased by 147 percent and molecular revenues increased 56 percent from the second quarter of 2014.

The firm noted that infectious disease product revenues were up 17 percent, led by sales of influenza and Strep A products. Influenza sales were up 38 percent to $9.0 million, the result of a 135 percent increase in Sofia influenza orders and a 25 percent increase in QuickVue influenza orders over the second quarter of last year. Sales of Strep A products grew 13 percent to $6.8 million.

“While QuickVue tests for influenza and Strep A grew in the second quarter, our new products were responsible for the largest portion of revenue growth in the period,” Quidel President and CEO Douglas Bryant said in a statement.

Quidel posted a net loss of $8.9 million, or $.26 per share, in Q2 2015, compared to a loss of $6.9 million, or $.20 per share, in the year-ago quarter. On a non-GAAP basis, loss per share was $.14, beating the Wall Street estimate of $.25.

The company increased its R&D costs slightly year over year to $9.1 million from $8.1 million, and increased its SG&A costs to $17.9 million from $15.2 million.

Qualcomm to Lay Off 15 Percent

Of Workforce and Consider Spinoff

Times of San Diego

San Diego-based Qualcomm confirmed Wednesday that it plans to lay off 15 percent of its global workforce and study a restructuring under pressure from a hedge fund investor.

The changes include cutting costs by $1.1 billion a year, adding three new board members approved by the hedge fund Jana Partners, and studying a possible spin off of part of the company.

Review of the corporate structure will be completed by the end of the year, the company said, and will include “possible business separation alternatives.”

“We are making fundamental changes to position Qualcomm for improved execution, financial and operating performance,” said CEO Steve Mollenkopf. “We are right-sizing our cost structure and focusing our investments around the highest return opportunities while reaffirming our intent to return significant capital to stockholders and refreshing our board of directors.”

Jana Partners applauded the announcement. “We support the bold steps the board and management are pursuing to enhance stockholder value and are pleased to have worked constructively with them in this endeavor,” said Barry Rosenstein, managing partner.

The company also announced significantly lower profit and revenue for its third fiscal quarter. Qualcomm earned $1.2 billion, or 73 cents per share, on revenue of $5.8 billion in the quarter ended June 28, down from earnings of $2.2 billion, or $1.31 per share, on revenue of $6.8 billion a year ago.

Qualcomm said it expects its sales and revenue to be lower in the fourth fiscal quarter as well.

Shares of of the company, off 21 percent over the past year, slipped 2 percent to $62.70 in after-hours trading on Wednesday.

Qualcomm is a world leader in 3G, 4G and next-generation wireless technologies. It is biggest supplier of chips for mobile phones and also licenses key patents to other manufacturers. Jana Partners has urged the company to split the two businesses.

The past year has been turbulent for Qualcomm, with key customer Samsung beginning to use its own chips, China levying a $975 million antitrust fine and the European Union beginning an investigation.

Janney Montgomery Scott Downgrades Illumina

GenomeWeb

Following Illumina’s miss on the consensus Wall Street estimate for its revenues, investment bank Janney Montgomery Scott on Wednesday downgraded shares of the firm to a Neutral rating from a previous Buy rating.

Analyst Paul Knight maintained the fair value of Illumina’s shares at $240.

On Tuesday, Illumina reported revenues of $539.4 million for the second quarter, a 21 percent increase year over year but short of the analyst average estimate of $541.8 million.

In his note, Knight noted concerns about both Illumina’s sequencing and microarray businesses. While Illumina’s sequencing revenues grew a “robust” 28 percent year over year and Knight estimated a 23 percent to 27 percent growth rate for the remainder of the year, some have suggested that long-term growth in the whole-genome sequencing space will slow as researchers move to application-specific methods.

“The sequential slowdown in (Illumina’s) instrument growth lends credence to this viewpoint and the robust growth seen in clinical/translational medicine and oncology further supports a shifting demand,” Knight wrote. “We believe this dynamic deserves further inspection for (Illumina’s) investors.”

Meanwhile, Illumina’s microarray business fell in the double digits. “We expected a better performance from the array segment,” Knight said.

In Wednesday afternoon trading Illumina’s shares were down 8 percent to $217.85 on the Nasdaq.

Scripps Research Institute Awarded

$4.5 Million to Develop HIV/AIDS Vaccine

The Scripps Research Institute (TSRI) has been awarded two grants from the Bill & Melinda Gates Foundation totaling more than $4.5 million to fund efforts to develop a vaccine against HIV/AIDS.

“We are delighted by the Gates Foundation’s support of this critical work,” said Jim Paulson, acting president and CEO of TSRI. “With 35 million infected individuals worldwide, an effective HIV vaccine is urgently needed to slow and ultimately eliminate new infections.”

The new grants, awarded through the foundation’s Collaboration for AIDS Vaccine Discovery program, will provide new tools in TSRI’s High Resolution Electron Microscopy Facility to collect and process high-resolution images of HIV proteins interacting with antibodies (immune molecules), giving scientists a picture of which immunogens (substances that induce immunity) are most effective and why.

“This puts everything under one roof so we can better evaluate HIV vaccine candidates,” said TSRI Associate Professor Andrew Ward, who will lead the five-year initiative.

UC San Diego Raises $1 Billion for Research

UC San Diego raised $1 billion in research funding during the fiscal year that ended June 30 — the fourth time since 2010 that the school has broken the billion dollar mark.

“The figure reflects the creativity of our faculty,” said Pradeep Khosla, the university’s chancellor.

More than half of the money was raised in health sciences and medicine, underwriting everything from experimental treatments for Parkinson’s disease to efforts to better map how brain cells communicate.

The money is expected to maintain UC San Diego’s position as one of the six or seven largest research schools in the U.S. San Diego Union-Tribune

HP Investors Acquires Retail/Office

Building in Downtown San Diego

HP Investors, LLC announced that it completed the acquisition of a 6,000- square-foot industrial property in Downtown San Diego for $1.5 million. The property, located at the corner of 15th and E streets, lies at the primary intersection of Makers Quarter in the East Village neighborhood and marks the firm’s 11th investment in Downtown San Diego.

The property consists of a 7,500-square-foot land parcel improved with a 6,000-square-foot building in the middle of the Makers Quarter neighborhood, a six block residential neighborhood, employment hub, and retail destination being jointly developed by HP Investors together with Lankford & Associates and Hensel Phelps. The property will be repositioned with the help of designer Paul Basile of Basile Studios into a dynamic creative retail and office space over the next 9-15 months.

“We are excited to integrate this property in the Upper East Village into the Makers Quarter vision,” said Sumeet Parekh, managing partner of HP Investors. “This unique property lies at the heart of new district, and we believe its transformation will be a catalyzing force not only for our larger project, but for the neighborhood as a whole.”

Dempsey Finishes Construction

Of Holiday Inn Express & Suites

Dempsey Construction has completed the ground-up construction of the new 87-room Holiday Inn Express & Suites located at 635 Hotel Circle South in Mission Valley.

The project featured the construction of a six-story concrete and wood frame structure located directly behind the Vagabond Hotel. The new hotel features a one-level subterranean parking garage.

In order to accommodate the new structure, a portion of the Vagabond Hotel was demolished and a significant amount of grading, shoring and site work completed on the property’s southern end, said Dempsey Construction project manager Paul Prellwitz.

The new Holiday Inn Express & Suites features a number of amenities including swimming pool, courtyards and media/business center.

Construction took place while the adjacent hotel remained open and operating.

The Holiday Inn Express is owned, and was developed, by The Hotel Investment Group. The project architect was Robert F. Tuttle Architect, Temecula.

Construction Begins on 317-Unit

Gated Community in Oceanside

Presidio Residential Capital and Cornerstone Communities have broken ground on Pacific Ridge, a 30-acre, 317-unit gated community being built on the last remaining land within the Rancho del Oro master planned community in Oceanside. Model construction is expected to begin in January 2016, with homes for sale by summer 2016.

Pacific Ridge will consist of three communities with distinct product types, all with two-car, side-by-side garages, luxury finishes and private yards. Lucero will offer 125 three-and-a-half to four-bedroom townhomes ranging from 1,570 to 1,825 square feet. Brisas will offer 120 two-story three- to four-bedroom and up to three-and-a-half-bath townhomes ranging from 1,480 to 1,812 square feet. Altura will offer 72 upscale three-to four-bedroom, two-and-a-half-bath two-story single-family detached homes ranging from 1,770 to 2,030 square feet.

Pacific Ridge residents will have access to numerous community amenities, including a heated lap pool, a spa within an expansive open-air and covered lounge area, covered dining and entertaining space with barbecues, scenic vantage point seating areas, a dog park, a flexible outdoor fitness space and a community walking path.

Pacific Ridge is one of three projects that Presidio Residential Capital and Cornerstone Communities are developing. These projects include Tuscany Village, 212 units in Bakersfield, and Otay 225 units in Chula Vista.

San Diego Community College District

Expects 53,000 Enrollment for Fall

An estimated 53,000 students are expected back when fall semester classes resume Aug. 24 at City, Mesa and Miramar colleges of the San Diego Community College District. Open enrollment begins Aug. 3.

The 53,000 students is a four percent increase over last fall. Students will have 150 additional course sections to choose from. Many classes are offered online.

To accommodate new student demand, the college district is hiring 31 additional full-time faculty members between now and January. Many of these new faculty members bring years of teaching experience, having worked locally as adjunct professors.

California community colleges charge $46 per unit.

In addition to the district’s three for-credit colleges, San Diego Continuing Education offers free adult education classes. Continuing Education’s fall semester begins Sept. 8.

How to Leverage Video Marketing To Grow Your Local Business

Personnel Announcements

Broacast Company of America Hires Sales Director

Broadcast Company of the Americas, which operates The Mighty 1090 AM, 105.7 MAX-FM and ESPN 1700 AM, has hired Tim McCarthy as the new director of sales for the company.

McCarthy, a San Diego State graduate, has most recently been the national sales manager for KUSI TV for the last five years. Prior to that, he was the director of sales for Dickey Broadcasting in Atlanta, owners of three sports stations in that market. Before Atlanta, Tim was with Clear Channel Communications in San Diego as both the general sales manager of 91x and Star 94.1, as well as director of play by play sales for their Charger Radio Network. McCarthy was also the general manger of XHRM FM when it was owned by Binational Broadcasting/San Diego.

Christopher Bissonnette Joins MassMutual San Diego

Christopher Bissonnette has joined the management team of MassMutual San Diego, a general agency of Massachusetts Mutual Life Insurance Company, to assist in the overall development of the firm in Southern

California. This includes management, recruiting, training, marketing and compliance.

Bissonnette began his financial career in 1994 and has overseen and built financial planning teams for several Fortune 500 companies in Orange County, Los Angeles, San Diego, Phoenix and Atlanta.

Enter the Blue Sky — Live at the Ché Café

Ché Café will host Enter the Blue Sky as they bring their thoughtful, upbeat, original lyric and vocally-driven Americana music to the iconic venue on the UC San Diego campus on Friday at 9 p.m.

Enter the Blue Sky plays all original material, with an energy and great sound that is a serious toe tapping, make-ya-want-to-sing-along experience, the kind of memorable sounds where you find yourself humming the tunes on your way home from the show, with lyrics that are thoughtful and melodies that are hard to forget.

An award-winning vocalist, lead Sandé Lollis is a powerhouse of energy and melody, she is backed by three talented and passionate instrumentalists. Karen Childress-Evans, on viola, brings achingly beautiful tones and a classic sensibility to the band. Jodie Hill, bass player, is a creative backbone with smokey smooth playing and background vocals. John Seever’s harmonica underlays dreamy chords and explosive leads adding depth to the band’s unique sound.

Ché Café, 1000 Scholars Drive, La Jolla, UCSD campus.