Daily Business Report-Jan. 21, 2021

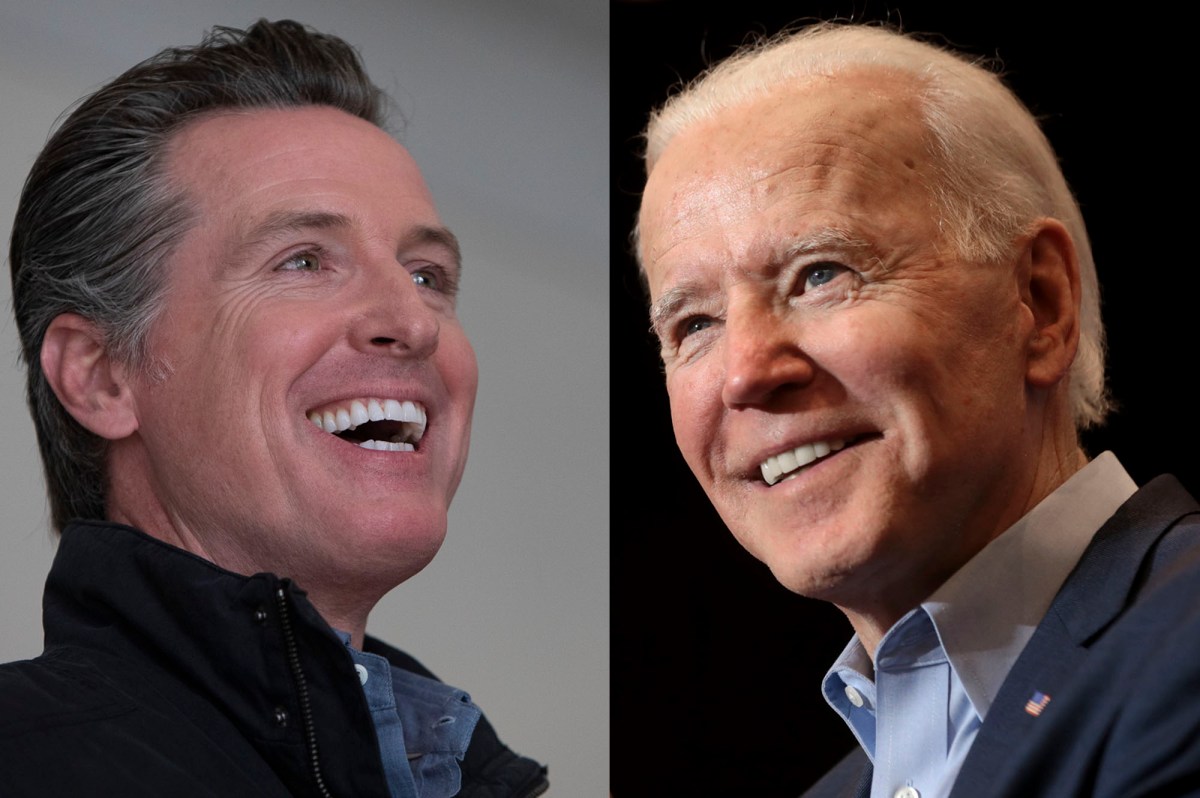

Gov. Gavin Newsom; President Joe Biden. (Photos by Anne Wernikoff, CalMatters; Gage Skidmore via Flickr)

A new era for California?

Gov. Newsom asks President Biden for aid

By Emily Hoeven | CalMatters

What a difference a day makes.

On Tuesday, California was still wrangling with the Trump administration, as evidenced by nine final-hour lawsuits filed by Attorney General Xavier Becerra — bringing his four-year total to a staggering 122 lawsuits.

On Wednesday, Joe Biden and Kamala Harris were sworn in as president and vice president of the United States, ushering in what many California Democrats hope will be a new era of less contention and more collaboration.

Hours later, Harris was expected to swear in Alex Padilla as California’s first Latino senator. And the Golden State could gain yet another powerful ally in Washington if the Senate confirms Becerra as Health and Human Services secretary.

In a letter to Biden, Gov. Gavin Newsom expressed California’s eagerness “to support your bold agenda by sharing our experiences implementing progressive policy on everything from workers’ rights to climate change.” But even as Newsom depicted California as a model for national programs, he hinted at numerous challenges facing the state. Here’s a breakdown of key requests Newsom made of the Biden-Harris administration: Funding for California’s beleaguered high-speed rail project, which is years behind schedule and billions of dollars over budget; funding to sustain programs like Project Homekey, an effort to permanently house homeless Californians in hotels and motels; authority for California to set its own emissions standards, the subject of protracted legal battles with the Trump administration; emergency funding for state and local governments, which wasn’t included in the December stimulus package.

SANDAG refinances Mid-Coast Trolley Project

SANDAG refinanced its outstanding Transportation Infrastructure Finance and Innovation Act (TIFIA) loan for the Mid-Coast Trolley project by securing a replacement loan at a significantly lower interest rate of 1.75 percent, which will save more than $123 million during the life of the 25-year loan, according to its officials.

The financial strategy comes in the final year of construction of the Mid-Coast Trolley project, which will extend the UC San Diego Blue Line Trolley 11 miles, from Old Town to the University community. The project will add nine new Trolley stations, including two on the UC San Diego campus. Service is expected to begin in late 2021.

“Refinancing the loan for the largest infrastructure project in the region’s history is great news for the region,” said SANDAG Chair and Encinitas Mayor Catherine Blakespear. “Reducing the long-term borrowing costs for this project means there is more money available for other critical transportation projects. Executing smart fiscal decisions is a hallmark of the SANDAG approach.”

U.S. Commerce Department awards $5.98 million

grant to San Diego to mitigate flooding

The U.S. Commerce Department’s Economic Development Administration (EDA) is awarding a $5.98 million grant to the city of San Diego to make stormwater infrastructure improvements needed to mitigate the impact of flooding on local industry. The EDA grant, to be matched with $5.98 million in local investment, is expected to help retain 2,000 jobs.

The project will support the final design, permitting, easement acquisition, and construction of vital infrastructure needed to protect San Diego businesses.

The project is funded under the Bipartisan Budget Act of 2018 in which Congress

appropriated to EDA $600 million in additional Economic Adjustment Assistance Program funds for disaster relief and recovery.

Kaiser Permanente pledges $100,000

for San Diego-based refugee nonprofit

Kaiser Permanente pledged $100,000 in grants this month to the San Diego-based nonprofit Partnership for the Advancement of New Americans to help refugee families throughout the San Diego region. “We’ve always worked on reducing inequity in our communities because we believe health care must be affordable for all — it’s a requirement for individuals, families, and communities to thrive,” said Jane Finley, Kaiser senior vice president, and area manager. “This initiative aligns with that effort because we’ve chosen to focus on providing grant money to uplift under-resourced communities and populations.”

The Partnership for the Advancement of New Americans’ mission is to advance realistic resettlement strategies for newcomer families supporting their long-term economic self-sufficiency. The grant is part of a $25 million commitment Kaiser Permanente announced last June to “promote health equity and break the cycle of racism- driven stresses that lead to poor health outcomes for its members and communities.”

OnPoint Development to build

68,000-square-foot industrial building

OnPoint Development, a San Diego-based retail, self-storage and industrial development company, announces development plans for a new, up to 68,000-square-foot industrial building in Escondido. The contemporary designed building will be OnPoint Development’s first industrial development project in San Diego County.

OnPoint Development plans to commence construction in summer 2021, with an expected completion in spring 2022. The planned industrial building is located on a 4.95-acre parcel at 2351 Myers Ave., Escondido. It will feature 26-foot clear heights, up to six dock high loading doors and between 4,000-6,000 square feet of mezzanine space.

Smith Consulting Architects is the project architect and Tucker Hohenstein of Colliers International San Diego Region will handle leasing efforts.

Tri Pointe Group and its six builder brands

to operate under the name Tri Pointe Homes

Homebuilder TRI Pointe Group Inc. announced that it is consolidating its six regional homebuilding brands into one unified name – Tri Pointe Homes. In connection with the consolidation of brands, the publicly-traded entity, TRI Pointe Group Inc., has been renamed Tri Pointe Homes Inc., and each of its 15 divisions across the nation will operate under the name Tri Pointe Homes.

“The strategic decision to operate as one brand comes as we continue to organically grow our divisions across the country and look to drive more operational efficiencies at all levels of the organization,” said Tri Pointe Homes Chief Executive Officer Doug Bauer. “Operating as one brand will allow us to concentrate our functional efforts around one brand instead of six while creating a stronger national awareness for the company.”

San Diego Rotary names first woman

to executive director position

Jordan Maharaj has been named executive director of San Diego Rotary, the first woman and person of color to hold the position in the organization’s 110-year history.

As executive director, Maharaj will direct the day-to-day operations of the 500-plus member service organization. Her duties include managing a wide array of initiatives, including membership, finances and operations.

Maharaj came to San Diego Rotary after serving in various development leadership roles at San Diego State University. She possesses a strong service background and held several executive positions with other Rotary clubs during her high school and college years.

A Paul Harris Fellow, Maharaj joined San Diego Rotary in 2019. She received her bachelor’s degree in business administration from San Diego State University and is pursuing her master’s degree in public administration from her alma mater.

Estate planning attorney Michele Muns Devine

joins Seltzer Caplan McMahon Vitek

Michele Muns Devine has joined the San Diego law firm Seltzer Caplan McMahon Vitek’s Estate Planning Practice Group as of counsel. Devine focuses her practice on estate planning, trust, wealth transfer planning and trust and probate administration.

She advises businesses and individuals with diverse financial, tax and asset protection requirements, charitable gift planning and estate tax planning.

A Certified Specialist in estate planning, trust and probate law by the State Bar of California Board of Legal Specialization, Devine holds more than 24 years of experience advising clients on sophisticated and multigenerational planning issues, and preparing revocable trusts, special needs trusts, irrevocable trusts, wills, powers of attorney and advance health care directives.

Prior to joining SCMV, Devine was a partner at the Muns Law Firm, where she focused on estate planning, tax and business planning for clients in the San Diego community.

She received her J.D. from the University of California, Hastings College of the Law, her B.A, cum Laude, from the University of California, Los Angeles and her L.L.M. in taxation, with honors, from the University of San Diego.

BlueNalu secures $60 million in financing

BlueNalu, a food company producing a variety of seafood products directly from fish cells, announced the closing of $60 million in debt financing from new and existing investors. This marks the largest financing to date in the cell-based seafood industry worldwide.

Previously, BlueNalu announced completion of its Series A round of $20 million in early 2020, and its Series Seed round of $4.5 million in early 2018.

The financing is intended to enable BlueNalu to achieve several significant milestones over the coming year, including opening a nearly 40,000 square foot pilot production facility, completing FDA regulatory review for its first products, and initiating marketplace testing in a variety of foodservice establishments throughout the United States.

BlueNalu plans to introduce a wide variety of cell-based seafood products from its pilot production facility in San Diego. The company anticipates starting with the launch of mahi mahi later this year, followed by the launch of a premium bluefin tuna thereafter.

Qualcomm announces quarterly cash dividend

Qualcomm Inc. on Wednesday announced a quarterly cash dividend of $0.65 per common share, payable on March 25, 2021, to stockholders of record at the close of business on March 4, 2021.

Petco announces closing of initial public offering

Petco announced the closing of its initial public offering of 55,200,000 shares of Class A common stock, including the full exercise by the underwriters of their option to purchase 7,200,000 additional shares of Class A common stock, at a price to the public of $18 per share. The Class A common stock is listed for trading on the Nasdaq Global Select Market under the ticker symbol WOOF. Petco received net proceeds from the offering of approximately $939 million, after deducting underwriting discounts and commissions.

Goldman Sachs & Co. LLC and BofA Securities acted as joint lead book runners for the offering. Citigroup, Evercore ISI, Credit Suisse, UBS Investment Bank and Wells Fargo Securities acted as joint book runners, and Baird, Guggenheim Securities, AmeriVet Securities, C.L. King & Associates, R. Seelaus & Co., LLC, Ramirez & Co. Inc. and Siebert Williams Shank acted as co-managers for the offering.